How will the crypto exchanges be regulated? And how should these exchanges build compliance programs to meet their obligations? Similar to other financial services, there’s the imperative to prevent money laundering and other financial crimes. There’s also an economic drive for innovation and promoting decentralization and other cryptocurrency benefits.

While these regulations solidify, crypto exchanges need to understand their current obligations in different global markets. For exchanges to succeed long-term, creating programs that anticipate future requirements and quickly adapt will have a clear advantage over slower-moving organizations.

Robust, holistic compliance solutions will protect your customers now, ensuring that their assets and accounts are as safe as possible in what can be a volatile market. These measures will also protect investors and the industry, helping future-proof your organization. Proactively building dynamic compliance processes enable quick implementation for any market, regulatory demand or risk control.

To help you build strong, flexible, compliant onboarding solutions, Trulioo is sponsoring a Coindesk webinar:

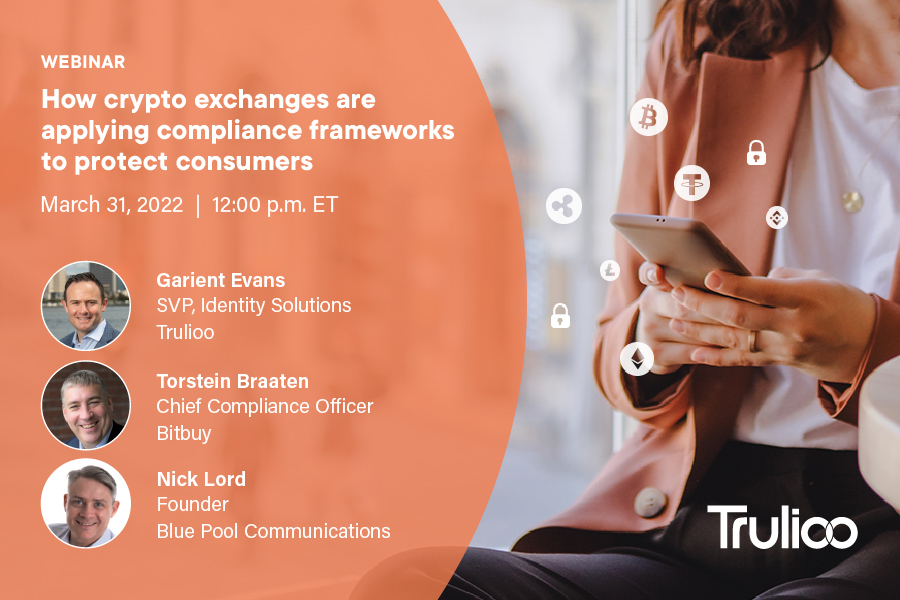

How crypto exchanges are applying compliance frameworks to protect consumers

Thursday, March 31 @ 12:00 p.m. (ET)

As cryptocurrencies go mainstream, experienced and novice investors alike have flocked to digital trading and investment platforms. This surge in popularity has prompted regulatory reform and accelerated the development of new measures to mitigate financial crimes and protect consumers. Join this exclusive webinar to hear how crypto exchanges are future-proofing their onboarding programs to meet compliance obligations and safeguard their users.

Guests include:

* Torstein Braaten, Chief Compliance Officer, Bitbuy

* Garient Evans, SVP, Identity Solutions, Trulioo

* Nick Lord, Founder, Blue Pool Communications

Sign up for the Coindesk webinar

Crypto regulations in flux

Bitcoin has been around for over ten years, yet regulations are often unclear. For example, paying with Bitcoin is legal in some jurisdictions, while others outright ban it. In El Salvador, it is now legal tender.

On top of that, there are thousands of other tokens with different models, use cases, governance structures and token economics (ownership percentages, supply and distribution). New sub-sectors are quickly gaining popularity, such as stablecoins, DeFi, NFTs and DAOs that bring up whole new regulatory considerations.

Questions about which regulatory agency is best suited to oversee various tokens can lead to confusion, inter-agency disputes and delays. Is a token a security, a commodity or a currency? Multiply this by the global nature of crypto, with all the legal variations and permutations and it’s easy to see why there’s confusion around compliance practices.

When new crypto laws come in, or when regulators formalize new requirements, will your exchange be ready? When you decide to enter a new market, will you have to start from scratch and go through the entire compliance endeavor again? Do you have effective crypto Know Your Customer (KYC) procedures in place? Will you be ready for the next wave of innovation, the next hot market and have your compliance and onboarding systems in place?

The world of crypto moves fast. Ensure you have a compliance framework that can keep up and protects your exchange and your customers.

More crypto: ID Verification | KYC for crypto | Resources | Posts

Solutions

Cryptocurrency

Optimize Your Crypto Onboarding

Resources Library

Cryptocurrency

Industry Sheets

Safety First: How Identity Verification Strengthens Customer Trust in the Evolving Crypto World

Featured Blog Posts

Individual Verification (KYC)

KYC: 3 Steps to Achieving Know Your Customer ComplianceBusiness Verification (KYB)

Enhanced Due Diligence Procedures for High-Risk CustomersIdentity Verification

Proof of Address — Quickly and Accurately Verify AddressesIndividual Verification (KYC)

Top 10 Questions About Beneficial Ownership for AML/KYC ComplianceBusiness Verification (KYB)

How to Verify Legitimate Businesses and MerchantsIndividual Verification (KYC)

Customer Due Diligence Checklist — Five Steps to Improve Your CDD